Your solicitor’s aim is to maximise the amount of compensation you receive for your injuries and other losses.

Your solicitor’s aim is to maximise the amount of compensation you receive for your injuries and other losses.

The “top line” value of your claim needs to be as high as possible, but that’s not all.

You also want to try to reduce the amount you will lose in having to pay legal fees from your compensation.

For most people who become a personal injury client of Moray Claims / Grigor & Young, you will lose 10 per cent of your compensation in paying what is called a “Success Fee”.

In a minority of cases, though, no deduction will apply at all.

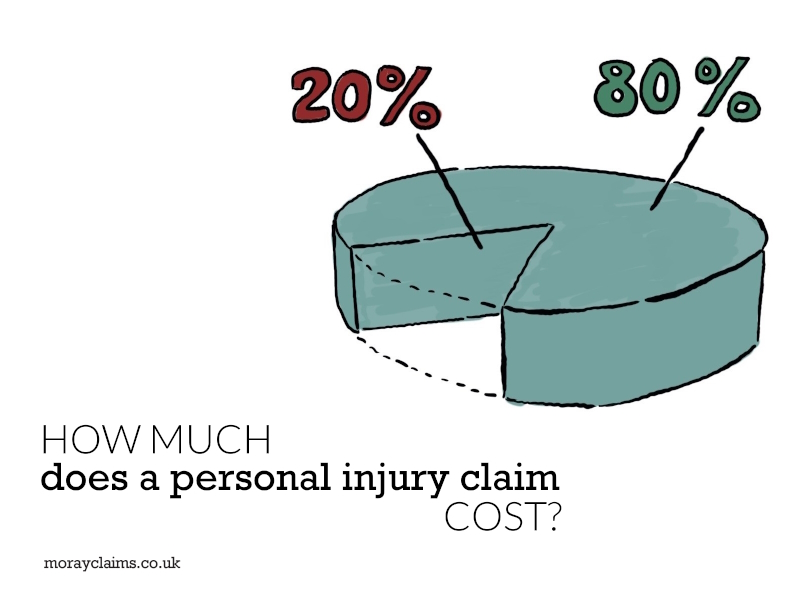

The basic difference is between claims covered by legal aid (no deduction ever) and claims we deal with on a no win-no fee basis (10 per cent deduction in most cases and, rarely, 20 per cent).

So , how much does a personal injury claim cost? And how can you minimise what you will have to pay out of your damages?

As we will see, it can mean the difference between receiving 100% of your compensation and only 80% – and the reduction has nothing to do with contributory negligence.

Putting it another way, how would you feel if your claim settled at £75,000 and you only received £60,000 when, with a different firm of solicitors handling your claim, you would have received £67,500?

A “hidden” cost in some cases.

One of the hidden factors in the economics of personal injury claims relates to how much of your compensation you will actually receive if your claim succeeds.

Few people consider this matter at the outset of a claim.

It’s hardly surprising.

You’ve got so many other things to worry about, including recovering from your injuries and staying afloat financially, if you are not fit to work.

But the nature of the agreement about what fees will be payable is an important consideration when you are deciding which solicitor you want to help you with your claim.

Arithmetic features heavily in this article because it is easier to explain what we mean by worked examples.

The examples illustrate how crucial it is to be clear at the start what sort of feeing agreement you are entering into with your solicitor.

It could make a significant difference to the amount of compensation you receive in your hands at the end of your claim.

“No win-no fee” and legal aid

At Moray Claims / Grigor & Young, we take on personal injury claims in two main ways.

We either deal with them “no win-no fee” or using legal aid.

Legal Aid is still available for personal injury claims in Scotland, though the position may change in future.

Many solicitor firms in Scotland which specialise in personal injury have decided to concentrate on no win-no fee and no longer offer legal aid as an option.

Insurance required for no win-no fee claims

You need to make sure your no win-no fee claim is covered by some kind of insurance.

An “After the Event” policy, such as we offer at Moray Claims / Grigor & Young, will do the job or insurance via a claims funding company set up by the solicitors themselves.

A common arrangement for no win-no fee is for you to sign an agreement in which you agree that, if your claim is successful, your solicitor will receive a percentage of your compensation.

The basis for this “Success Fee” is that your client is taking a risk under no win-no fee. The “risk” is that the claim will fail. If the claim fails, your solicitor will not get any payment for the work they have done on your behalf. For that reason, so the argument goes, if your claim succeeds, your solicitor should get a “bonus” as payback for the risk they took in your interests.

Paying an agreed percentage to your solicitor.

Caps (“limits”) imposed by government legislation have applied to Success Fee percentages that can be charged in no win-no fee personal injury claims since April 2020.

These are the maximum percentages that your solicitor can charge as a Success Fee and they are:

- Up to 20% of the first £100,000 of damages;

- Up to 10% for the next £400,000; and

- Up to 2.5% of damages over £500,000.

All these percentages are inclusive of VAT at 20%.

In other words, if the compensation in a case is £100,000, the maximum Success Fee is 20 per cent – i.e. £20,000.

In fee terms, for the solicitor, that equates to maximum fees of £16,667 with VAT of £3,333.

Note that, as a percentage of the total amount of compensation, you lose less for a bigger claim than a smaller claim. The maximum percentage loss on £60,000 compensation is a straightforward 20% (i.e. £12,000 deducted, leaving £48,000) (it’s 20% because £60,000 is below the £100,000 threshold).

On £600,000, however, it is much more complex. The maximum deduction would be £20,000 + £40,000 + £2,500 = £62,500. As a percentage of £600,000, £62,500 is about 10.4 per cent.

Maximising total damages and minimising deductions.

Many firms will emphasise how they maximise the value of your claim and often get for clients two or three times the initial offer, by the time the claim settles.

We say that’s fair enough but it’s only half the story.

You must also look at what is being taken away from your compensation to pay the Success Fee.

At Moray Claims at Grigor & Young, in most no win-no fee cases, we charge a 10 per cent Success Fee on the first £100,000 of compensation, 5% on the next £400,000 and 2.5% on any compensation over £500,000.

Moray Claims / Grigor & Young scenario 1: legal aid.

If we deal with your claim under legal aid, there is no deduction from your compensation if the claim settles successfully.

So, if your claim settles at £40,000 before or after court action is raised, you receive all of that amount.

Under the sort of “no win – no fee” arrangement we have described above, the loss would be 20% – i.e. £8,000

You would receive only £32,000 in your hands.

Moray Claims / Grigor & Young scenario 2: “no win – no fee” pre-litigation or in the Sheriff Court.

If we deal with your claim “no win – no fee” and it settles without the need for a court action or after proceedings have been raised in the Sheriff Court, in most cases (settling at or court-awarded at £100,000 or less), we will charge a Success Fee of 10 per cent.

So, if your claim settles at £17,000, you receive £15,300. Contrast this with the 20% deal, above. Under that, you lose £3,400. You receive £13,600.

Moray Claims / Grigor & Young cases where a deduction is inevitable: Court of Session actions.

As we are a small firm in Moray and do not have an Edinburgh office, we need to get help from Edinburgh solicitors if we decide that a Court of Session action is the best way to maximise your compensation and you accept that advice.

The deal we propose in these situations has a basic Success Fee of 20 per cent and, in the event of success, that Success Fee is split equally between Grigor & Young and the Edinburgh agents (i.e. 10 per cent each).

Summary: deductions matter.

When you are deciding who should handle your personal injury claim for you, don’t just look at what they say about maximising the value of the claim.

Also consider what is likely to be taken off your compensation before you receive it.

It is so easy to overlook this and yet it could make many thousands of pounds of difference at the end of the claim.

How we can help

For more information about this article or any aspect of our accident and injury claims service, please call us on 01343 544077 or Make A Free Online Enquiry.

We will be delighted to help you in any way we can.

We do not charge for initial telephone discussions.

Through Moray Claims at Grigor & Young LLP we aim to provide local advice from specialist, personal-injury-law-accredited solicitors in such a way that your personal injury claim is free if it fails, and costs you no more than 10% of your compensation if it is successful (and sometimes even then will cost you nothing).

Make A Free Online Enquiry Now

Note:

This post is an updated and republished version of an original post on this website dated 15 September 2014.