It’s natural to be suspicious if someone seems to be offering you something valuable in return for nothing. We are all conditioned to think that if something sounds “too good to be true”, then it must in fact be too good to be true. There are times when we’re vulnerable to letting our guard down – for example, if it’s something we really want – and system tools have evolved to provide some protection. For example, many spam filters will catch emails with “free” in the subject line because use of that one word alone indicates dodgy intentions on the part of the sender. But just because a service is offered as 'provided free of charge' to you, it's not necessarily dodgy as long as the service provider is getting by some other method - such as happens with solicitors working for claimants with personal injury claims. We invite people to ask us questions via our Google Business page. You can ask a question of Moray Claims on Google Business here. You can see the questions Continue Reading

Funding a personal injury claim

This can be a confusing subject and the funding landscape for personal injury claims is constantly shifting.

These articles deal with a range of topics in relation to funding personal injury claims, including:

- No win-no fee

- Legal aid

- Legal expenses insurance, generally

- Before the Event (BTE) insurance,

- After the Event (ATE) insurance, and

- Qualified One-way Cost-Shifting (QOCS)

How Does Your Personal Injury Solicitor Make Money If They Do Not Charge You Anything?

One of my favourite rock bands is the Canadian trio, Rush. I have seen them live in concert 5 times between 1981 and 2013. They were inducted into the Rock ‘n’ Roll Hall of Fame in 2013, having released their first album as long ago as 1974. By 1976, Rush were about to release their fourth album. Their previous LPs had been relative commercial failures. And so their record label encouraged them to ditch the ‘concept album’ format – with whole sides devoted to a single theme or story – which they had followed for albums 2 and 3. In fact, they stuck to their philosophy. Side 1 has the 7-part suite of the album’s title, set in a musically intolerant world, now less than 100 years in the future. 2112 (“Twenty-one Twelve”) went on to become arguably their most famous record; it was certainly their breakthrough. The final track on Side 2 is called ‘Something for Nothing’ and has the chorus: You don't get something for nothing You don't get freedom for free You won't get Continue Reading

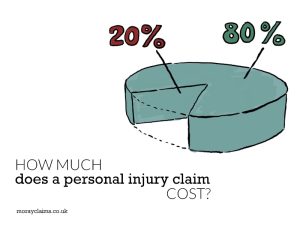

How Much Does A Personal Injury Claim Cost?

Your solicitor’s aim is to maximise the amount of compensation you receive for your injuries and other losses. The “top line” value of your claim needs to be as high as possible, but that’s not all. You also want to try to reduce the amount you will lose in having to pay legal fees from your compensation. For most people who become a personal injury client of Moray Claims / Grigor & Young, you will lose 10 per cent of your compensation in paying what is called a "Success Fee". In a minority of cases, though, no deduction will apply at all. The basic difference is between claims covered by legal aid (no deduction ever) and claims we deal with on a no win-no fee basis (10 per cent deduction in most cases and, rarely, 20 per cent). So , how much does a personal injury claim cost? And how can you minimise what you will have to pay out of your damages? As we will see, it can mean the difference between receiving 100% of your compensation and only 80% - and the Continue Reading

Digging for QOCS Exceptions in Scottish Personal Injury Claims

The default position under Qualified One-way Costs Shifting (QOCS) for personal injury compensation claimants in Scotland is this. If your claim succeeds, you will be able to recover legal costs from your opponent, in addition to the compensation agreed as payable or as awarded to you by a court. Whether you lose any of your compensation to pay a success fee will depend upon the arrangement you have with your solicitor. If your claim is unsuccessful, QOCS should mean that you DO NOT have pay legal costs to your opponent - even though the normal rule is “loser pays”. That is what “one-way costs shifting” means. There’s a shift in the usual costs rule in favour of the loser if they are claimant; but not if they are the claimant’s opponents (usually an insurance company). QOCS arrived in England and Wales (2013) before it came to Scotland (2021). To some extent, Scotland has been learning from the experience south of the Border. In 2023, there have been some Continue Reading

Why it is best to get your choice of personal injury solicitor right first time

Filmmakers have a wide variety of camera techniques at their disposal to help them tell their story to best effect. One of the most powerful tools directors can employ is the split diopter lens, which makes it possible to have two subjects at different distances in the frame simultaneously – and both in focus. In his 1951 film, Strangers on a Train, Alfred Hitchcock wanted a telephone to be in a foreground close-up while actors in the background remained in focus. This was to emphasise the importance of the incoming phone call. The limitations of camera lenses at the time meant he could not make it work. He fixed the problem by having a giant phone in the foreground and putting a regular-sized phone in Ruth Roman’s hand as she came to answer it. The camera view tilted up as she approached (moving the monster phone out of shot). The 1984 film comedy, Top Secret, spoofed that set-up, with the foreground telephone remaining in shot throughout and the army officer Continue Reading

How Grigor & Young help you with a road traffic accident injury claim in Moray

Grigor & Young LLP, Solicitors, use Moray Claims as a trading name in their business of dealing with personal injury compensation claims for clients. Grigor & Young have offices in Elgin and Forres, Moray. Personal injury compensation claims arising from road traffic accidents are usually against insurers of the driver who was to blame for the accident. If that driver was uninsured or is untraced, the claim may be against the Motor Insurers' Bureau. Injuries resulting from road traffic accidents can happen in many different ways. If we take on your claim at G&Y, it will be via one of the following three funding methods. Legal aid Whether you qualify for legal aid depends upon your financial circumstances. If you qualify for legal aid, we will give close consideration to using that as the funding mechanism for the claim though we will also discuss with you the other options mentioned below. Note that, if your claim is successful under any form Continue Reading

How Grigor & Young help you with an accident-on-premises claim in Moray

Grigor & Young LLP, Solicitors, use Moray Claims as a trading name in their business of dealing with personal injury compensation claims for clients. Grigor & Young have offices in Elgin and Forres, Moray. Claims arising from accidents on premises are usually against the person or business which has control over the land or buildings in question. Injuries resulting from accidents on premises – also known as occupiers’ liability claims – can result in a wide variety of ways. If we take on your claim at G&Y, it will be via one of the following three funding methods. Legal aid Your eligibility for legal aid depends upon your financial circumstances. If you qualify for legal aid, we will look closely at using that as the funding mechanism for the claim though we will also discuss with you the other options mentioned below. It is worth noting that, if your claim is successful under any form of Scottish legal aid, you will receive 100% of your Continue Reading

How Grigor & Young will help you with your accident at work claim in Moray

Moray Claims is a trading name of Grigor & Young LLP, Solicitors. Grigor & Young have offices in Elgin and Forres, Moray. Accidents at work cover a wide range of accidents. If we take on your claim at G&Y, we will do so in one of three ways. Legal aid Eligibility for legal aid will depend on your financial circumstances. If you qualify for legal aid, we will give serious consideration to using that as the funding mechanism for the claim but we will also discuss with you the other options mentioned below. Note that if your claim is successful under any form of Scottish legal aid, you will receive 100% of your compensation. The legal aid rules prevent your solicitor taking any form of Success Fee as a deduction from your compensation. "Before the event" (BTE) insurance This is a type of legal expenses insurance which you may have attached to buildings or contents insurance, for example. Many people have this type of legal expenses insurance cover Continue Reading

How personal injury claim funding got to its best-ever position in Scotland

In jokes, lawyers are never portrayed as the cream of society. Musicians like to make jokes about each other. Drummers and viola players are a bit dim; accordionists and banjo players are downright annoying (because their instruments are 'loud' and drown out others nearby). Here are a couple of cartoon-based jokes where lawyers and banjo players are on opposite sides. (A) Lawyer (probably a lawyer rather just a "businessman" - because his discomfort is doubly delicious) in a lift (elevator), talking on his mobile phone: "I'm trapped in an elevator. Wait it gets worse..." (The other occupant of the lift is a banjo player). It works better in the original... (B) Father to young child who is holding a banjo and standing on a chair to be high enough to see the music on their music stand: "Certainly a law degree is a worthwhile endeavour, son, but you need something to fall back on. Now practise your banjo." (Lawyers' response: Ouch). You wouldn't necessarily expect to be Continue Reading

What are the downsides of QOCS for Scottish personal injury claimants?

We've talked about Qualified One-Way Costs Shifting (QOCS) before now because it is an important topic. In Scotland, the "normal rule" whereby an unsuccessful claimant for personal injury compensation will no longer have to pay court costs / expenses if the claim fails will have various exceptions. In these situations, the claimant will lose QOCS protection and have to pay the costs of their opponent. The claimant will only be liable for their opponent's expenses in Scotland where they have: We have waited three years for the QOCS regulations to come in. They were enacted from 30 June 2021. In many respects, the regulations mirror those already in force in England and Wales. The basic principle is the same and the exceptions are largely the same. Abuse of process, behaving manifestly unreasonably and also acting fraudulently or making a fraudulent misrepresentation. One big difference is that Scotland has not enacted any equivalent concept to England and Continue Reading

What’s qualified one-way cost-shifting for personal injury claims in Scotland?

"Give me 10 men like Clouseau and I could destroy the world," These were the words of Chief Inspector Charles Dreyfus (Herbert Lom), long-suffering superior of the hilariously inept Inspector Jacques Clouseau (Peter Sellers) in the Pink Panther films of the 1960s and 70s. Another crucial supporting role to Clouseau was that of Cato Fong (Burt Kwouk – pronounced “Kwok”), the Inspector’s Chinese manservant, trained to spring regular surprise attacks on his boss to keep him alert and practised in martial arts. A prime example of Clouseau’s extreme destructive power is in one apartment scene where, with Cato’s assistance, he destroys not only a four-poster bed and a TV set but also inflicts structural damage on the flat below, occupied by the hysterically twitching Dreyfus. We could say that Burt Kwouk’s role was crucial in support of Peter Sellers’ performance. And, because we love a pun, we could also say that, in the context of personal injury claims, QOCS (which is Continue Reading

What pricing will apply to our help with your personal injury claim in Moray?

When asked about his nationality, legendary Scottish fiddler, Johnny Cunningham, liked to tell people that he was half Scottish and half Irish. This explained, he said, why half of him wanted to drink all the time and the other half never wanted to pay for it. Everyone prefers a free option if it’s realistic… …and cost is one important aspect of personal injury compensation claims. What is it that personal injury clients want? In many cases they will say that it’s about “justice”. It’s the principle of the thing. In practice, what this boils down to is questions about how much your claim is likely to be worth and how long it is all likely to take to get justice for you. From the solicitor’s point of view, the main question tends to be: “Is there a claim?” - Will we be able to prove someone caused your injury by negligence? And, of course, another important question you’ll have is: “How much is it going to cost me to get help from this solicitor? Cost Continue Reading