What are the things you must do to prove your loss - and to minimise your loss - in a Personal Injury Compensation Claim? How easy is it to value a personal injury compensation claim? In theory, working out the value of your personal injury claim should be straightforward. What your solicitor needs to do is make a comparison between two possible factual scenarios: Both of these key elements are estimates or projections, to some extent. Both will carry uncertainties, to a greater or lesser extent. There are two important things to bear in mind when comparing "your life as it is in fact" (with the accident) with "your life as is should have been" (without the accident). Let's look at each of these in turn. 1. Did the accident cause the loss you are trying to claim. In some instances, this will be “obvious”. For example, if your accident did not cause any injury to your wrist, a claim for physiotherapy costs incurred in relation to the wrist will fail Continue Reading

Services Claims: Help From Your Family After An Accident

(NOTE: This is an updated version of a post originally published on this website on 24 October 2013). If you have been injured in an accident, it may well have put you out of action for a while with the result that you needed help from members of your family. The law in Scotland allows relatives to claim compensation for the time they give up to help you. This might seem strange: you would hope and expect they would do that anyway, without requiring any financial reward. On the other hand, if they were not there to help you, it would make life awkward, at best, and unmanageable, at worst, unless you could get help from some other source. So it makes sense that compensation should be available for them for the time involved in providing you with assistance. Their claim does not stand on its own; it can only be made as part of a personal injury claim by you, the injured person. Two Types of Services Claim There is the possibility to make a claim for two different types of services under Continue Reading

How Does Your Personal Injury Solicitor Make Money If They Do Not Charge You Anything?

One of my favourite rock bands is the Canadian trio, Rush. I have seen them live in concert 5 times between 1981 and 2013. They were inducted into the Rock ‘n’ Roll Hall of Fame in 2013, having released their first album as long ago as 1974. By 1976, Rush were about to release their fourth album. Their previous LPs had been relative commercial failures. And so their record label encouraged them to ditch the ‘concept album’ format – with whole sides devoted to a single theme or story – which they had followed for albums 2 and 3. In fact, they stuck to their philosophy. Side 1 has the 7-part suite of the album’s title, set in a musically intolerant world, now less than 100 years in the future. 2112 (“Twenty-one Twelve”) went on to become arguably their most famous record; it was certainly their breakthrough. The final track on Side 2 is called ‘Something for Nothing’ and has the chorus: You don't get something for nothing You don't get freedom for free You won't get Continue Reading

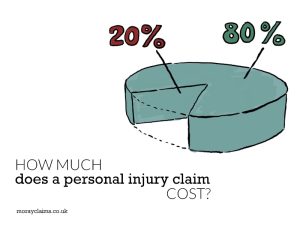

How Much Does A Personal Injury Claim Cost?

Your solicitor’s aim is to maximise the amount of compensation you receive for your injuries and other losses. The “top line” value of your claim needs to be as high as possible, but that’s not all. You also want to try to reduce the amount you will lose in having to pay legal fees from your compensation. For most people who become a personal injury client of Moray Claims / Grigor & Young, you will lose 10 per cent of your compensation in paying what is called a "Success Fee". In a minority of cases, though, no deduction will apply at all. The basic difference is between claims covered by legal aid (no deduction ever) and claims we deal with on a no win-no fee basis (10 per cent deduction in most cases and, rarely, 20 per cent). So , how much does a personal injury claim cost? And how can you minimise what you will have to pay out of your damages? As we will see, it can mean the difference between receiving 100% of your compensation and only 80% - and the Continue Reading