It’s natural to be suspicious if someone seems to be offering you something valuable in return for nothing. We are all conditioned to think that if something sounds “too good to be true”, then it must in fact be too good to be true. There are times when we’re vulnerable to letting our guard down – for example, if it’s something we really want – and system tools have evolved to provide some protection. For example, many spam filters will catch emails with “free” in the subject line because use of that one word alone indicates dodgy intentions on the part of the sender. But just because a service is offered as 'provided free of charge' to you, it's not necessarily dodgy as long as the service provider is getting by some other method - such as happens with solicitors working for claimants with personal injury claims. We invite people to ask us questions via our Google Business page. You can ask a question of Moray Claims on Google Business here. You can see the questions Continue Reading

After the Event Insurance Articles

Below, you can find our articles dealing with After The Event Insurance – which is an essential means of safeguarding your interests in most no win-no fee claims.

How Does Your Personal Injury Solicitor Make Money If They Do Not Charge You Anything?

One of my favourite rock bands is the Canadian trio, Rush. I have seen them live in concert 5 times between 1981 and 2013. They were inducted into the Rock ‘n’ Roll Hall of Fame in 2013, having released their first album as long ago as 1974. By 1976, Rush were about to release their fourth album. Their previous LPs had been relative commercial failures. And so their record label encouraged them to ditch the ‘concept album’ format – with whole sides devoted to a single theme or story – which they had followed for albums 2 and 3. In fact, they stuck to their philosophy. Side 1 has the 7-part suite of the album’s title, set in a musically intolerant world, now less than 100 years in the future. 2112 (“Twenty-one Twelve”) went on to become arguably their most famous record; it was certainly their breakthrough. The final track on Side 2 is called ‘Something for Nothing’ and has the chorus: You don't get something for nothing You don't get freedom for free You won't get Continue Reading

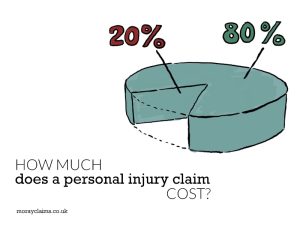

How Much Does A Personal Injury Claim Cost?

Your solicitor’s aim is to maximise the amount of compensation you receive for your injuries and other losses. The “top line” value of your claim needs to be as high as possible, but that’s not all. You also want to try to reduce the amount you will lose in having to pay legal fees from your compensation. For most people who become a personal injury client of Moray Claims / Grigor & Young, you will lose 10 per cent of your compensation in paying what is called a "Success Fee". In a minority of cases, though, no deduction will apply at all. The basic difference is between claims covered by legal aid (no deduction ever) and claims we deal with on a no win-no fee basis (10 per cent deduction in most cases and, rarely, 20 per cent). So , how much does a personal injury claim cost? And how can you minimise what you will have to pay out of your damages? As we will see, it can mean the difference between receiving 100% of your compensation and only 80% - and the Continue Reading

FAQs about After the Event Insurance and Speculative Fee Agreements

Given the way we deal with personal injury claims on a ‘no win- no fee’ (or ‘speculative’) basis at Moray Claims / Grigor & Young, we have to have ‘After the Event’ (‘ATE’) insurance in place. ATE insurance is “after the event” in the sense that your accident was the “event”. If you did not have any ‘Before the Event’ insurance in place (e.g. legal expenses insurance included as part of your house contents insurance) and you do not qualify for legal aid, we need to find another way to insure against the risk that your claim will be unsuccessful and a court makes an award of costs/expenses against you. ATE insurance insures against that risk of adverse costs. In this article, we will consider three questions related to ATE insurance and the speculative fees agreement we get you to sign in conjunction with the ATE insurance. Continue Reading

Personal Injury Claim First Enquiries – How Much Scope For Free Advice?

We end most articles on this blog with a call to action along the lines of “get in touch if you have any questions – all initial enquiries are free”. We’ve received a request for clarification of this. The question came via email - “When is a contract deemed to have started after first enquiry?” I take that to mean: at what point do you get beyond the point of initial enquiry, where everything is "without obligation", and get bound into taking things further with that particular solicitor? With personal injury claim first enquiries, how much scope for free advice do you have? We handle most personal injury claims in one of two ways here and I will try to explain what happens in each case (there's a general summary, below, if you want to skip to that). Legal aid cases If you qualify for some form of legal aid, we will encourage you to sign up for legal advice and assistance, which is the initial form of legal aid, covering meetings, correspondence and Continue Reading

Personal Injury Lawyer In Moray (How To Focus Your Search For A Solicitor)

If you live in Moray or have been injured in an accident which happened in Moray, here are some factors to consider if you need to choose a solicitor to help you with a personal injury claim. Are you going to use a local solicitor or one who is at a distance from you? A Moray solicitor will have local knowledge, which could be useful and give them an advantage over someone who is not based in the area. For some types of accident - for example, pavement tripping accidents - it can be crucial for someone (often, the solicitor!) to visit the locus of the accident as soon as possible after the accident in order to take photographs and make measurements. A local solicitor is going to be better-placed to carry out such work. Or maybe not. Google Streetview and other free online tools mean that a virtual visit to a locus is often possible and this may be sufficient, depending upon the type of accident. So, it may not be essential to have a local solicitor to deal with your Continue Reading

After the Event Insurance (Crucial for No Win–No Fee Personal Injury Claims)

After the Event Insurance is needed to protect you in case you lose your no win-no fee claim After the Event (ATE) insurance is where you take out an insurance policy after a legal problem or dispute has arisen in order to protect you against the risk of having to pay the other side’s legal costs if you lose. Why is this type of insurance important for “no win-no fee” personal injury claims? The difference between winning and losing your claim We have seen how your solicitor will get paid for their work for you on a no win–no fee arrangement if they are successful in getting personal injury compensation for you. It’s one thing to look at a winning scenario but it’s also important to be alive to the possibility that your claim might not succeed. What then? No win–no fee means you won’t have to pay anything to your solicitor for their work, if you lose. However, you could be at risk of having to pay other costs if things don’t work out in your favour. Under no win–no fee, failure Continue Reading