You don’t usually get something for nothing. We’ve talked about that issue before when answering the question: How does your personal injury solicitor make money if they do not charge you anything? In the context of a personal injury compensation claim, claiming for wage loss when you are not losing any wages sounds like getting something for nothing – getting a windfall - but it’s not like that at all. To understand how you might claim for future wage loss when you’re not currently losing any wages, we need to consider 3 things, which we’ll do in the remainder of this article. Firstly, how is wage loss normally calculated? Secondly, in what circumstances, might you be able to claim wage loss when you’re not losing any wages? And, finally, how is the calculation made? Let’s look at wage loss claims generally, for a start. If you have a personal injury claim, wage loss may be an important part of your claim. It may be the main reason you decided to make a claim at Continue Reading

If You Are Off Work After An Accident What Rights Do You Have To Receive Pay (or other benefits)?

The Telegraph newspaper reported in January 2014 about a doctor at Barts Hospital in London who had erroneously received a “banding supplement” of £4,000 per month for on-call duties. This went on for more than two-and-a-half years, with the incorrect payments totalling £126,000. Overpayments of wages can occur in a variety of ways, including genuine payroll errors and miscalculation of commission/bonus schemes. According to the report, the £126,000 mistake (which was the most expensive of many) was to be resolved by the doctor paying it back at £500 per month. That would take over 21 years. While overpayments of wages can and do occur (as seen above), where you’ve been injured and are off your work as a result, you’re much more likely to be experiencing an underpayment of wages. The negative financial consequences of being injured in an accident can be significant. What steps can you take to make sure you maximise your income in the aftermath of an accident which leaves you Continue Reading

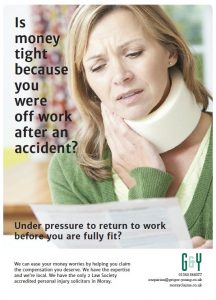

Financial pressure to return to work too soon after an accident?

If you are off work as the result of an accident, you can easily find yourself under increasing pressure to go back to your job before you are fully fit to do so. Many people are forced into making a claim for personal injury compensation due to financial stresses. Often, this is because their employment does not provide sick pay at full pay or even half pay rates. If you are more or less immediately on Statutory Sick Pay through absence from work after an accident, you will inevitably have worries how you will manage to pay your bills and provide for your family. This wage loss seems especially unfair, if you were injured at work. If you live in Moray or have suffered a personal injury accident in Moray, we can help with advice on a possible personal injury claim. We can take any claim on directly, if that is in your best interests. We will refer you on elsewhere if we think that’s a better option for you. Our priority is to make sure everyone with a valid claim gets fair Continue Reading

Accidents at Work – Loss of Earnings

Where you have been injured in an accident, a common consequence is that you will not be fit for work for a period of time. We often find that our personal injury clients who are victims of accidents in the workplace - in situations where it was the employer's breach of duty that caused the accident - only decide to make a claim at all because during their absence they receive wages at a reduced rate. It seems unfair that not only have you been injured due to your employer's fault but you then also suffer a personal / family financial crisis. Some employers have a company sick pay scheme, usually set out in the employee's written terms and conditions. If you have the benefit of a scheme like this, it will often mean you getting full pay for some weeks or months, then half pay, eventually reducing to nil. If you are injured and there is no employer's scheme in place, you may still be eligible for statutory sick pay (SSP), the standard weekly rate for which is currently £85.85 Continue Reading