It’s natural to be suspicious if someone seems to be offering you something valuable in return for nothing. We are all conditioned to think that if something sounds “too good to be true”, then it must in fact be too good to be true. There are times when we’re vulnerable to letting our guard down – for example, if it’s something we really want – and system tools have evolved to provide some protection. For example, many spam filters will catch emails with “free” in the subject line because use of that one word alone indicates dodgy intentions on the part of the sender. But just because a service is offered as 'provided free of charge' to you, it's not necessarily dodgy as long as the service provider is getting by some other method - such as happens with solicitors working for claimants with personal injury claims. We invite people to ask us questions via our Google Business page. You can ask a question of Moray Claims on Google Business here. You can see the questions Continue Reading

Legal Expenses Insurance Articles

Below are listed our articles covering Legal Expenses Insurance, as it relates to Personal Injury Claims.

How Grigor & Young help you with an accident-on-premises claim in Moray

Grigor & Young LLP, Solicitors, use Moray Claims as a trading name in their business of dealing with personal injury compensation claims for clients. Grigor & Young have offices in Elgin and Forres, Moray. Claims arising from accidents on premises are usually against the person or business which has control over the land or buildings in question. Injuries resulting from accidents on premises – also known as occupiers’ liability claims – can result in a wide variety of ways. If we take on your claim at G&Y, it will be via one of the following three funding methods. Legal aid Your eligibility for legal aid depends upon your financial circumstances. If you qualify for legal aid, we will look closely at using that as the funding mechanism for the claim though we will also discuss with you the other options mentioned below. It is worth noting that, if your claim is successful under any form of Scottish legal aid, you will receive 100% of your Continue Reading

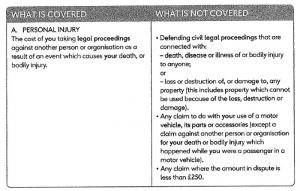

Knowing whether Legal Expenses Insurance covers you for a personal injury claim

We thought it might be helpful to analyse a clause from a legal expenses insurance (LEI) policy relating to cover for making a personal injury claim. It’s just one type of clause out of many in a LEI policy but it is a foundational one relative to personal injury claims. What is LEI? LEI is one way to insure yourself against the risk that a personal injury compensation claim you make might fail in such a way that you could be responsible for the costs (legal expenses) of your opponent. Typically, that can only happen if you get to the stage where you have to raise a court action to pursue your claim – so legal expenses insurance is insuring you against the risk of losing your claim in court. While it is possible to buy LEI as a standalone policy, most LEI policies are added to home or car insurance as an optional extra. LEI policies bought ‘before the event’ (BTE) protect policyholders in case legal action has to be brought or defended in the future. This type of policy would be Continue Reading

Is Legal Expenses Insurance worth it?

Legal expenses insurance (LEI) is also known as legal protection insurance or even just legal insurance. It can pay for the cost of legal advice, if you need help, in a variety of scenarios - for example - a boundary dispute with a neighbouring property owner a building dispute with a tradesman who has done work on your house an employment dispute a personal injury compensation claim following an accident The insurance can cover you whether you are the person initiating the claim or the person against whom the claim is being made. The main benefit of LEI is that it provides you with a route to justice which may otherwise be too expensive for you to consider. It can be a stand-alone policy but is often an add-on to other insurance, such as house contents insurance. Types of LEI There’s an important distinction between ‘before the event’ (BTE) LEI and ‘after the event’ (ATE) LEI. The ‘event’ is the thing that's happened for which you need the legal advice Continue Reading

How legal expenses insurance can give you access to justice (that might otherwise be denied)

I was renewing my first aid qualification recently and some statistics really hit home. Less than 1 in 10 people in Britain survive an out-of-hospital cardiac arrest. In countries where cardiopulmonary resuscitation (CPR) is taught in schools on the other hand (e.g. Norway), as many as 1 in 4 survive. It seems that providing folks with an early education in first aid fundamentals improves heart attack victims’ chances of making it through their experience alive. In the same way, a recent report by a group of international lawyers has argued that making Legal Expenses Insurance (LEI) more widely available would improve access to justice, giving some people a possible legal remedy where otherwise their chances would be as good as dead. In this article, we are going to consider 3 questions related to LEI. Firstly, what is LEI and what types of LEI exist? Secondly, who is most likely to benefit from taking out LEI? And, lastly, why you should make a general check of Continue Reading

9 Questions to ask your Legal Expenses Insurer if you want your own solicitor to handle your personal injury claim

In other articles, we have discussed how legal expenses insurance can help minimise the cost risk to you if you need to make a personal injury claim for compensation. The term “legal expenses insurance” can include both before-the-event (BTE) insurance and after-the-event (ATE) insurance. With ATE insurance, the insurance policy is taken out after the accident in order to cover the risk of having to pay the opponent’s legal costs (for example, if you raise a court action but the claim fails and you lose). BTE insurance covers against future legal costs but was in place before the event which gave rise to the claim, such as the accident which has caused the personal injury for which you need to claim compensation. BTE insurance generally limits your freedom to choose your own legal representative because claimants are directed to use firms of solicitors which are on the BTE insurer’s approved panel. Panel firms may be located a considerable distance from your home, especially Continue Reading

Why you should always make use of insurance, if you have it

We criticise insurance companies on this blog quite often. Of course, insurance companies are frequently critical of solicitors who help people to make personal injury claims. They are also critical of claimants themselves. As well as people with possible personal injury compensation claims, we get a lot of enquiries from people who are worried that some sort of compensation claim might be made against them. If they have insurance cover, they are not sure if they should use it. If you have insurance that will help you defend a claim against you for personal injury (or property damage), you should make use of it. Here are a couple of very recent examples. The first scenario is a road traffic accident. Of course, in theory, it is compulsory to have motor insurance to cover you against the risk of liability to a 3rd party. In this case, the person making the enquiry to us had been driving at night in a suburban area. There was street lighting. The car in front was Continue Reading

3 ways timing is important with Legal Expenses Insurance

I was sad to read that one of my all-time favourite bands, Rush, are "basically done" after 41 years of music making. At times, as a child, I would listen to their LPs incessantly and many of the lyrics have stuck with me through my life. A Farewell to Kings (1977) was the first Rush record I bought and these words are from the title song: When they turn the pages of history When these days have passed long ago Will they read of us with sadness For the seeds that we let grow? We turned our gaze From the castles in the distance Eyes cast down On the path of least resistance Cities full of hatred Fear and lies Withered hearts And cruel, tormented eyes Scheming demons Dressed in kingly guise Beating down the multitude And scoffing at the wise As Rush sang in another song (Circumstances), quoting famous words attributed to Jean-Baptiste Alphonse Karr from the mid-19th century: "The more that things change, the more they stay the same." 40 years on, the last 4 Continue Reading

When does Legal Expenses Insurance cover you for a Personal Injury Claim?

Cammy Keith, the all-time leading goalscorer for Keith football club, went viral on social media following his side's lead to defeat to Rothes on 03 February 2018. Keith (the player) scored both goals for Keith (the team) and so, on results pages, it appeared as though he had almost achieved a near-impossible outcome: a draw where one player was up against a full team of 11 players. A tweet that he had put in the "quite the shift" was retweeted many times. Quite the shift for Keith on his own. pic.twitter.com/nkni1CMcvy — The Harry Wraggs (@THWtwit) February 3, 2018 In that case, the bare statistics gave a misleading impression as to whether it had been a fair match. As an injured person with a possible personal injury claim for compensation, it is never a fair match at the outset. You need to take every possible measure to tip the scales back to your side, even if you don't level them up completely. The scales are weighted in favour of the insurer on the other side Continue Reading

Do you have freedom of choice of personal injury solicitor?

Humans have an overpowering need to return favours. This is one pillar of the psychology of persuasion explored in Robert Cialdini’s book, “Influence”. The rule of reciprocity is that we feel a duty to repay others in kind for whatever they have done for us. It’s powerful because it forms the basis of all societies: it allowed our ancestors to share resources securely, knowing that their favour would be returned later. If someone else does us a favour, we feel a psychological burden until we return it. We’re afraid of being labelled as a parasite, if we don’t. Many experiments have demonstrated this phenomenon. In one of these - at Cornell University in the early 1970s - Professor Dennis Regan demonstrated that people are so anxious to get rid of the burden of debt that they will perform much larger favours in return for small ones. In that study, a researcher – “Joe” – bought test subjects a 10 cent Coke as an unprompted favour and then later asked the subjects to buy raffle Continue Reading

A Comparison Of Personal Injury Claim Funding Methods: No Win-No Fee vs Legal Aid vs Legal Expenses Insurance

In theory, you could run your Personal Injury Claim on a private fee-paying basis. You would have to pay your solicitor interim fees as the case progressed. You would have to pay for all outlays, including recovery of medical records and payment of expert witness fees. If your case went to Court, you would have to bear a hefty risk. Lose your case and you will not only have to pay the fees and outlays of your own solicitor; you will also be responsible for paying the fees and outlays of the opposing solicitor. Depending upon the complexity of the case and which Court any action is raised in, your legal bill would certainly be thousands of pounds and might be tens of thousands of pounds. Unless you have bottomless financial resources (in much the way that insurance companies do) private fee paying arrangements for personal injury claims are generally reckoned to be “a bad idea”. You need to be able to run your claim in a way which costs a lot less and carries a lot less Continue Reading

Do I Have To Use The Solicitor My Insurer Tells Me To Use?

We have blogged previously about Legal Expenses Insurance (LEI). If you have LEI and approach your insurer for cover under the policy to make, for example, a personal injury claim, you may find the insurance company saying that they have the right to appoint a solicitor of their choice to act for you. We often get asked the question: "Do I have to use the solicitor my insurer tells me to use?" The true position is that you do not have to go with their choice. Right to appoint own solicitor for proceedings It’s not entirely simple but under Regulations dating from 1990 (the Insurance Companies (Legal Expenses Insurance) Regulations) you have the right to select the solicitor who will be appointed in respect of any proceedings. Of course, the normal procedure with a claim is that your solicitor will intimate it by letter first of all and, in many cases, the claim can be negotiated to a successful conclusion without the need for a court action – in other words, without the Continue Reading