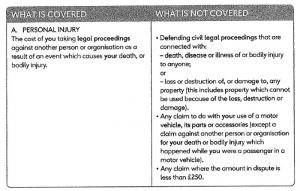

We thought it might be helpful to analyse a clause from a legal expenses insurance (LEI) policy relating to cover for making a personal injury claim. It’s just one type of clause out of many in a LEI policy but it is a foundational one relative to personal injury claims. What is LEI? LEI is one way to insure yourself against the risk that a personal injury compensation claim you make might fail in such a way that you could be responsible for the costs (legal expenses) of your opponent. Typically, that can only happen if you get to the stage where you have to raise a court action to pursue your claim – so legal expenses insurance is insuring you against the risk of losing your claim in court. While it is possible to buy LEI as a standalone policy, most LEI policies are added to home or car insurance as an optional extra. LEI policies bought ‘before the event’ (BTE) protect policyholders in case legal action has to be brought or defended in the future. This type of policy would be Continue Reading

Funding a personal injury claim

This can be a confusing subject and the funding landscape for personal injury claims is constantly shifting.

These articles deal with a range of topics in relation to funding personal injury claims, including:

- No win-no fee

- Legal aid

- Legal expenses insurance, generally

- Before the Event (BTE) insurance,

- After the Event (ATE) insurance, and

- Qualified One-way Cost-Shifting (QOCS)

Is Legal Expenses Insurance worth it?

Legal expenses insurance (LEI) is also known as legal protection insurance or even just legal insurance. It can pay for the cost of legal advice, if you need help, in a variety of scenarios - for example - a boundary dispute with a neighbouring property owner a building dispute with a tradesman who has done work on your house an employment dispute a personal injury compensation claim following an accident The insurance can cover you whether you are the person initiating the claim or the person against whom the claim is being made. The main benefit of LEI is that it provides you with a route to justice which may otherwise be too expensive for you to consider. It can be a stand-alone policy but is often an add-on to other insurance, such as house contents insurance. Types of LEI There’s an important distinction between ‘before the event’ (BTE) LEI and ‘after the event’ (ATE) LEI. The ‘event’ is the thing that's happened for which you need the legal advice Continue Reading

How legal expenses insurance can give you access to justice (that might otherwise be denied)

I was renewing my first aid qualification recently and some statistics really hit home. Less than 1 in 10 people in Britain survive an out-of-hospital cardiac arrest. In countries where cardiopulmonary resuscitation (CPR) is taught in schools on the other hand (e.g. Norway), as many as 1 in 4 survive. It seems that providing folks with an early education in first aid fundamentals improves heart attack victims’ chances of making it through their experience alive. In the same way, a recent report by a group of international lawyers has argued that making Legal Expenses Insurance (LEI) more widely available would improve access to justice, giving some people a possible legal remedy where otherwise their chances would be as good as dead. In this article, we are going to consider 3 questions related to LEI. Firstly, what is LEI and what types of LEI exist? Secondly, who is most likely to benefit from taking out LEI? And, lastly, why you should make a general check of Continue Reading

Reducing Success Fees paid by Scottish personal injury claimants

Success fees are the “hidden cost” of personal injury claims. They reduce the amount of compensation you receive from a personal injury claim after that compensation figure has been fixed and paid. Success fees are fees that are paid out of compensation (awarded or agreed) by successful personal injury claimants to their solicitors or claims management companies under a success fee agreement. In this article, we will look at how the Scottish Government wishes to regulate the maximum levels of success fee that can be charged – to provide a better financial outcome for injured people than they often get at present. First of all, in order to understand the context in which this is all happening, we need to look at wider changes that will soon affect Scottish personal injury claims. The Scottish Government intends to change the way personal injury claims are run in Scotland. This follows similar changes brought in in England and Wales. One big proposed change is to reduce Continue Reading

Why a personal injury element is essential to a no win-no fee claim

Or, to put it another way, why don’t pure property damage claims work no win no fee? Dealing with motor insurers can be a frustrating process. This article was prompted by a question via the Grigor & Young website. The person making the enquiry said of their dealings with the third party insurers: It is an ‘online’ process and one is left for long periods of time on the telephone (twice my phone has run out of power from being fully charged) while trying to get a response. The enquirer had been involved in a road traffic accident that was not their fault. Their car was damaged and needed repairs. The car belonged to one of their parents. They were insured to drive the parent’s car through their comprehensive insurance on their own car. Ordinarily, in a “comprehensive” scenario, you may well choose to claim under your own policy (even if the accident was not your fault) because you have a contract with your insurers. You have more control. You have more clout if Continue Reading

9 Questions to ask your Legal Expenses Insurer if you want your own solicitor to handle your personal injury claim

In other articles, we have discussed how legal expenses insurance can help minimise the cost risk to you if you need to make a personal injury claim for compensation. The term “legal expenses insurance” can include both before-the-event (BTE) insurance and after-the-event (ATE) insurance. With ATE insurance, the insurance policy is taken out after the accident in order to cover the risk of having to pay the opponent’s legal costs (for example, if you raise a court action but the claim fails and you lose). BTE insurance covers against future legal costs but was in place before the event which gave rise to the claim, such as the accident which has caused the personal injury for which you need to claim compensation. BTE insurance generally limits your freedom to choose your own legal representative because claimants are directed to use firms of solicitors which are on the BTE insurer’s approved panel. Panel firms may be located a considerable distance from your home, especially Continue Reading

Why you should always make use of insurance, if you have it

We criticise insurance companies on this blog quite often. Of course, insurance companies are frequently critical of solicitors who help people to make personal injury claims. They are also critical of claimants themselves. As well as people with possible personal injury compensation claims, we get a lot of enquiries from people who are worried that some sort of compensation claim might be made against them. If they have insurance cover, they are not sure if they should use it. If you have insurance that will help you defend a claim against you for personal injury (or property damage), you should make use of it. Here are a couple of very recent examples. The first scenario is a road traffic accident. Of course, in theory, it is compulsory to have motor insurance to cover you against the risk of liability to a 3rd party. In this case, the person making the enquiry to us had been driving at night in a suburban area. There was street lighting. The car in front was Continue Reading

How soon can you choose your own solicitor under Before the Event insurance?

We’ve covered the topic of Before the Event insurance in other articles. Before the Event (BTE) Insurance is legal expenses insurance you can choose to take out. It means that if, for example, you are injured in an accident, the insurance covers the cost of legal advice on the prospects of claiming compensation. It’s an alternative to other funding methods such as no win-no fee and legal aid. One of the friction points of BTE Insurance is that you usually have to use the BTE insurer’s own panel solicitor for legal advice in the early stages. The justification most commonly given is that BTE insurers prefer to use their own panel solicitors for valid commercial and quality-control reasons. You can’t use, say, your own local, specialist solicitor for advice under the policy in the initial stages of advice. (You can still use them for advice, it just won’t be under the policy - which may not be a problem, in fact). The situation changes if it becomes necessary to raise a court Continue Reading

Why it matters if you have a contribution for Civil Legal Aid

One of the ways to fund a personal injury claim is by means of legal aid. Advice and assistance is available to cover the preliminary work, including intimating the claim and negotiating with the third party or their insurers. If the negotiations break down for any reason, you will need to raise a court action if you are going to achieve a fair settlement of your claim. Under legal aid, you need to apply for Civil Legal Aid, which requires various forms to be completed. This includes providing details and vouching of your income and capital. The application is then submitted to the Scottish Legal Aid Board (SLAB) via an online system. SLAB have various tests they apply in determining whether civil legal aid should be granted. This includes such things as: the value of the claim (and whether this is significantly in excess of any offers that have been made already to settle your claim); the prospects of success (anything less than 50% chances of success is going to Continue Reading

3 ways timing is important with Legal Expenses Insurance

I was sad to read that one of my all-time favourite bands, Rush, are "basically done" after 41 years of music making. At times, as a child, I would listen to their LPs incessantly and many of the lyrics have stuck with me through my life. A Farewell to Kings (1977) was the first Rush record I bought and these words are from the title song: When they turn the pages of history When these days have passed long ago Will they read of us with sadness For the seeds that we let grow? We turned our gaze From the castles in the distance Eyes cast down On the path of least resistance Cities full of hatred Fear and lies Withered hearts And cruel, tormented eyes Scheming demons Dressed in kingly guise Beating down the multitude And scoffing at the wise As Rush sang in another song (Circumstances), quoting famous words attributed to Jean-Baptiste Alphonse Karr from the mid-19th century: "The more that things change, the more they stay the same." 40 years on, the last 4 Continue Reading

When does Legal Expenses Insurance cover you for a Personal Injury Claim?

Cammy Keith, the all-time leading goalscorer for Keith football club, went viral on social media following his side's lead to defeat to Rothes on 03 February 2018. Keith (the player) scored both goals for Keith (the team) and so, on results pages, it appeared as though he had almost achieved a near-impossible outcome: a draw where one player was up against a full team of 11 players. A tweet that he had put in the "quite the shift" was retweeted many times. Quite the shift for Keith on his own. pic.twitter.com/nkni1CMcvy — The Harry Wraggs (@THWtwit) February 3, 2018 In that case, the bare statistics gave a misleading impression as to whether it had been a fair match. As an injured person with a possible personal injury claim for compensation, it is never a fair match at the outset. You need to take every possible measure to tip the scales back to your side, even if you don't level them up completely. The scales are weighted in favour of the insurer on the other side Continue Reading

How we help you at Moray Claims

In the video below, Peter Brash of Moray Claims and Grigor & Young explains how we can help you with advice in relation to a possible personal injury claim, especially if you are in Moray. We recommend all injured people to get advice as soon as possible from a local, specialist solicitor. By doing that, you'll be clear about your rights and be in a position to get proper access to justice should you choose to go down the route of making a compensation claim. You need to speak to someone who is not only knowledgeable and experienced, but independent and definitely on your side. The insurers on the other side of your potential claim fit the "well-informed" bit but they're principally looking after the interests of their shareholders and not your interests, despite what they may tell you. In the video, Peter explains why "local is best", in our view. Early advice from a solicitor will set you off on the right track, with the best chance of avoiding all the pitfalls. And Continue Reading