Our blog shares clear, practical guidance on personal injury claims in Scotland — including fault, compensation, timescales, and dealing with insurers. Many of the articles answer questions we’re regularly asked by people who are unsure whether to claim, are dealing directly with insurers, or want to understand their rights before deciding what to do next. Start here: key guides Popular questions Common situations Back to the main blog page Editor’s note: This guide stays at the top of the list of blog posts to help new readers find key information. Continue Reading

FAQs

Below are listed all of our articles covering Frequently-Asked Questions (FAQs) in relation to Personal Injury Claims in Scotland.

Negligence: what is it?

Accidents which are no one's fault ... An accident is an event which could not reasonably have been foreseen by anyone and for which no one should be held responsible. If your injury is the result of such a mishap - a ‘pure’ accident - you will not be able to make a successful claim for compensation. ... Accidents which are someone's fault The modern idea of negligence dates from the 1930s. Negligence: what is it ? The basic definition of negligence that lawyers now use comes from the Scottish case of Donoghue –v- Stevenson. As a result of that case and other later cases, the law places defined limits on the classes of person who can claim and the types of injury for which they can claim. If you are going to be able to claim successfully, the person who injured you has to have been in such a position that they ought to have had you in mind when considering the possible impact of their actions in the circumstances. In practice, from the point of view of the person owing the duty of Continue Reading

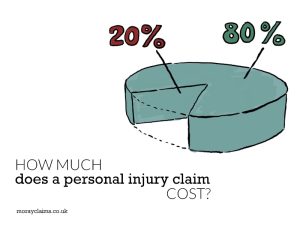

How Much Does A Personal Injury Claim Cost?

Your solicitor’s aim is to maximise the amount of compensation you receive for your injuries and other losses. The “top line” value of your claim needs to be as high as possible, but that’s not all. You also want to try to reduce the amount you will lose in having to pay legal fees from your compensation. For most people who become a personal injury client of Moray Claims / Grigor & Young, you will lose 10 per cent of your compensation in paying what is called a "Success Fee". In a minority of cases, though, no deduction will apply at all. The basic difference is between claims covered by legal aid (no deduction ever) and claims we deal with on a no win-no fee basis (10 per cent deduction in most cases and, rarely, 20 per cent). So , how much does a personal injury claim cost? And how can you minimise what you will have to pay out of your damages? As we will see, it can mean the difference between receiving 100% of your compensation and only 80% - and the Continue Reading

What is at stake if you do not make a personal injury compensation claim?

What do you stand to lose if you do not make a claim for personal injury compensation in a situation where that would be a realistic option for you? In this article, we will consider 3 ways you can lose out if you don't make a personal injury claim. The general principles here may be obvious but probably not all of the details will be known to you already. Knowing these things is an important part of your "informed consent" - i.e. having all the relevant points to hand before making your decision: to claim or not to claim. Firstly, we will look at your “loss” due to your failure to give yourself the benefit of monetary compensation. In fact, that loss does not just apply to you; it can apply to others who would have to rely on you making a claim in order for them to be compensated as well. Secondly, we will discuss the fact that you only have the choice to make a personal injury compensation claim for a limited period of time. The right does not last forever. Once the right Continue Reading

How to instantly increase the value of your personal injury claim by 25%?

The comic strip featuring Calvin and Hobbes has many recurring themes. For example, the opinion poll results showing that Calvin's Dad risks failing to be "re-elected" as Calvin's Dad in upcoming elections (elections which never seem to materialise). Calvin: (e.g.) "You rate especially low among tigers and six-year-old white males." Calvin's Dad: (e.g.) "I take comfort in the fact that not many people would want the job (i.e. the job of being "Calvin's Dad")." Another recurring theme is Calvin's fear of maths problems. It does not help that Hobbes (his pet, stuffed tiger) helps him in class and with homework. For example, Calvin: "What's 7 + 3?" Hobbes: "73." In one class quiz, Calvin considers the following problem: "Jack and Joe leave their homes at the same time and drive toward each other. Jack drives at 60 mph, while Joe drives at 30 mph. They pass each other in 10 minutes. How far apart were Jack and Joe when they started?" Calvin stares helplessly at the Continue Reading

Why keeping your personal injury claim simple (or as simple as possible) is best

“You’re ignorant. But at least you act on it.” So comments an eye-rolling Hobbes to Calvin in response to his friend’s rant about knowledge only leading to paralysis by analysis. That’s an outcome which, as a “man of action”, Calvin simply cannot afford. In other words, it’s a "simple" explanation for why Calvin will be better off not doing his homework. Calvin’s logic may be flawed but, with a personal injury claim, the simplest approach is usually the best. But can we keep things simple? In this article, we’ll consider, firstly, some of the factors that can complicate a personal injury claim. Secondly, we’ll look at complexity from the injured claimant’s perspective. And finally at “control” issues surrounding complexity: in other words, who has the power to make things simple or not? There are lots of ways a personal injury claim can become complicated. That's not a complete list by any means but it gives you a few examples of areas where complexity can Continue Reading

Help From The Other Driver’s Insurer (How To Avoid Being Misled)

An "innocent third party car claim" is how some motor insurers describe what you have if one of their customers has crashed into your vehicle and it’s not your fault. In other words, the motor insurers in question are the third-party insurers, not your own motor insurers. Their customer was to blame for the accident. The third-party insurers’ offer to you is that you should let them take care of you and your vehicle in sorting things out. This help from the other driver's insurer can include: the repair of your vehicle (or a payment to represent its value if it has been written off), use of a hire vehicle, free of charge, while your own vehicle is being repaired; and help if you have been injured – to include treatment/rehabilitation and compensation. But couldn't you deal through your own insurers? If you have comprehensive motor insurance, one of your options is to deal with a claim for damage to your car through your own motor insurers. This can be an involved process. You may Continue Reading

Getting what you need from the Moray Claims website?

UK Government guidelines advocate that their public-facing written content should meet the minimum reading age of nine years to ensure it is easily understood. Recent changes to the law on whiplash injury compensation in England and Wales (not affecting Scotland) have largely taken lawyers out of the equation for these "minor" injuries. The UK Government has provided a 64-page online guide for the injured people who will in future need to run their claims themselves, without help from a solicitor. These are what the Government has described as "simple" whiplash claims. But academic, Professor Roger Smith, has criticised the guide as "hopelessly complicated". According to what we might call the "9-year-old rule", authors of guidance material should consider, for example, adults with additional learning needs or imagine they are writing for an elderly relative. In Professor Smith's opinion, the whiplash guide “would be impenetrable to someone of that level of Continue Reading

Road Accidents: What To Do If A Court Action Is Raised Against You

We regularly get enquiries from people who have had a court action raised against them following involvement in a road traffic accident. If you are in that situation, what should you do? The typical scenario runs like this … You’ve had an accident with another vehicle when you were driving your car. The accident was your fault. The other vehicle was damaged or written off and the other driver was injured. Hopefully, you had comprehensive insurance and so your own vehicle will have been repaired or replaced by your insurers. They may also have told you they have settled the other party’s claim – by paying for the repair or replacement of their vehicle. Months later, out of the blue, you receive an Initial Writ or Summons (depending on whether the action against you is in the Sheriff Court or the Court of Session). This can be a startling experience, especially if the action is served on you by a Sheriff Officer or Messengers at Arms. The other driver – or maybe a passenger in that Continue Reading

Personal injury compensation and divorce

Personal injury claims come with stress attached. You have the strain of the pain and discomfort from the injury, the hassle of not being able to engage in everyday activities and possibly also the worry of loss of income through not being able to work. Coping with injury puts added pressure on your relationships. Particularly your closest relationships. This can lead to relationship breakdowns, whether that is splitting up with your boyfriend or girlfriend, or separating from your spouse or civil partner. Even the strongest relationships can be undermined. Personal injuries can be physical or mental, or both. As an injured person, you may develop depressive symptoms or changes in personality. In this article, we are going to look at what Scots law says about personal injury compensation in the context of relationship breakdown. We will focus particularly on financial provision on divorce or termination of civil partnership. We'll look at the situation Continue Reading

How to avoid throwing money away on your personal injury claim

Scottish solicitors’ firms have to do formal risk management training every year. This is particularly to minimise the risk of making mistakes which might mean we end up getting sued because of losses we might cause to our clients. We had a recent session in our Elgin office where the “system” to assess risks in our work on a daily basis was summarised as: Stop and think Do as you have been told (i.e. we have a lot of systems and procedures already for managing risk) Repeat one and two Everything looks clear with hindsight. You want to avoid looking back on things with regret, if possible. It can be especially annoying if, due to not “stopping and thinking”, you make a silly error which results in a loss to you personally or to your workplace. It’s a bit like that with personal injury claims and, from our perspective, there is an avoidable mistake many injured people make at the start of their personal injury claim. It causes financial loss to them. It’s not obvious, though, Continue Reading

Can insurers change their mind about settling your claim (if liability is admitted)?

Some say The Blue Nile are the greatest ever Scottish band. Though they only ever released 4 albums - between 1984 and 2004 - they maintained a consistently high standard throughout. Their music has a spare, cinematic quality which blends perfectly with Paul Buchanan’s soulful and world-weary voice. The Blue Nile’s 1989 release, Hats, has topped some polls to find the best Scottish album of all time. I listened to that album a lot when it came out - I was a student then - and I still listen to it often even now. The fact is, they almost never got a recording contract at all and took an unusual route to achieve that end. Around 1983, a top-of-the-range Glasgow-based hi-fi company called Linn Products found that their equipment’s sales prospects were boosted if they used music from the band’s demo tape when demonstrating Linn’s music systems to potential customers. When Linn discovered The Blue Nile were unsigned, they decided they would sort them with a record deal by Continue Reading