An "innocent third party car claim" is how some motor insurers describe what you have if one of their customers has crashed into your vehicle and it’s not your fault. In other words, the motor insurers in question are the third-party insurers, not your own motor insurers. Their customer was to blame for the accident. The third-party insurers’ offer to you is that you should let them take care of you and your vehicle in sorting things out. This help from the other driver's insurer can include: the repair of your vehicle (or a payment to represent its value if it has been written off), use of a hire vehicle, free of charge, while your own vehicle is being repaired; and help if you have been injured – to include treatment/rehabilitation and compensation. But couldn't you deal through your own insurers? If you have comprehensive motor insurance, one of your options is to deal with a claim for damage to your car through your own motor insurers. This can be an involved process. You may Continue Reading

Why a personal injury element is essential to a no win-no fee claim

Or, to put it another way, why don’t pure property damage claims work no win no fee? Dealing with motor insurers can be a frustrating process. This article was prompted by a question via the Grigor & Young website. The person making the enquiry said of their dealings with the third party insurers: It is an ‘online’ process and one is left for long periods of time on the telephone (twice my phone has run out of power from being fully charged) while trying to get a response. The enquirer had been involved in a road traffic accident that was not their fault. Their car was damaged and needed repairs. The car belonged to one of their parents. They were insured to drive the parent’s car through their comprehensive insurance on their own car. Ordinarily, in a “comprehensive” scenario, you may well choose to claim under your own policy (even if the accident was not your fault) because you have a contract with your insurers. You have more control. You have more clout if Continue Reading

Uninsured and untraced drivers and personal injury claims

It's compulsory to have insurance to cover the risk that a third party will suffer loss because of your driving That’s the case whether the “injury” is to property or a person. As at 2016, however, figures published by Churchill Insurance suggested that, across the UK, there were estimated to be over a million uninsured motorists. In the worst urban hotspots (e.g. parts of London), you have as much as a one in eight chance that any motorist involved in an accident with you will be uninsured. What are important things to know if you are involved in an accident with an uninsured (or untraced) driver? The Government set up the Motor Insurers’ Bureau (MIB) in 1946. It is a limited company and it aims to help those who have suffered loss due to the actions of an uninsured or untraceable driver. The underlying principle is that no person should be left uncompensated because a driver who causes an accident is uninsured. Since the 1970s, the MIB has been an important means by Continue Reading

What are your rights following a road traffic accident that was not your fault?

The Competition & Markets Authority (CMA) is a UK government department, responsible for strengthening business competition and preventing and reducing anti-competitive activities. In September 2014, it produced a report following an investigation into the private motor insurance market. One of the things they considered was the possibility of providing improved information to consumers on their rights following an accident. They noted that there appeared to be market-wide support for such a measure. CMA found a poor level of awareness among consumers about their basic rights following a road traffic accident that was not the consumer's fault. The report summarises the legal and factual background to its remit. It explains how the law requires motorists to hold a valid insurance policy to cover “third party” risks. In other words, insure against the risk they will injure another person or their property through their driving and have to pay compensation for those Continue Reading

Removing Right To Claim For Whiplash Injury Is Thin End Of The Wedge

As a bus passenger most days between Lossiemouth and Elgin, the recent unreliability of the Stagecoach service has been a regular topic of conversation. It has made me wonder how you can give an incentive to provide on-time servicing to a company with a virtual monopoly of the local bus service. How about we all get the automatic right to claim compensation from Stagecoach for our hassle and inconvenience every time a bus is more than 15 minutes late? An end to compensation for minor whiplash In his Autumn Statement for 2015, the Chancellor announced that the Westminster government intends to introduce measures to end the right to compensation for minor whiplash injuries. (We don't know yet how 'minor' is to be defined). Scotland not included Our understanding is that these proposed reforms would apply only to England and Wales (and not Scotland or Northern Ireland). However, we’re highlighting these proposals because we consider the principle to be so important. The Continue Reading

Insurers Not Getting In Touch After An RTA (Why That Might Be)

How long does it take for Insurers to get in touch after a road traffic accident? That’s a question we received recently in the following terms: “I was involved in an RTA two months ago. I have not heard from the insurance company yet. How long does it take for them to get in touch? The accident was not my fault.” A significant collision - with lots of post-accident worries It turns out this accident involved a rear end shunt at a junction. The vehicle was pushed right off the road by the impact. The injured driver who contacted us had been knocked unconscious as a result of the crash. He spent two nights in hospital, was off work for several weeks and lost wages. An incorrect assumption He had been driving his works van and thought that his employers’ motor insurers would take care of his claim for his injuries and his financial losses, including his loss of earnings. This was a classic situation where you, as the accident victim, have suffered injury through no Continue Reading

How To Get All The Crucial Details After A Road Traffic Accident

If you're involved in a RTA, there's crucial information you need to get We were on the main road south. We had not even made it out of Moray on our journey to Edinburgh. Accident A car approached from a minor road which formed a T-junction with our road, on our left. It should have given way to us but it didn’t; instead, it pulled out right in front of us and I could not stop in time. The front of our car hit the driver’s side of the other car, at the rear wheel arch. I had not been going fast and our speed at impact was probably less than 20 mph. Nevertheless, it was enough to cause the other car to spin right round, so it ended up facing into the junction it had come out of. What we did immediately after the accident I switched off the engine. I didn’t remember to switch on the hazard warning lights but my wife, in the passenger seat, did. I got out of the car and found the other driver was already out of his car. We established that both vehicles were Continue Reading

How Insurance Disclosure Reform Can Help Your Claim Succeed (And Save You Money)

Consumer claims on home and other insurance policies should now succeed more easily We’re now just over a year into a new legal framework which could benefit you, as a consumer, if you have to make a claim on insurance and your insurer refuses to honour it. The range of consumer insurance policies affected is very wide indeed. In our experience, most people have a wrangle with an insurance company sooner or later. This change to the law is something worth bearing in mind if you find yourself in dispute with an insurer over a claim you have made on a policy. The fatal mistake – failure to disclose Typically, the scenario is one where your insurer says that, at the time you took out the insurance (or renewed it), you failed to tell them about some important fact which would have influenced the level of premium – or even whether they would have agreed to insure you at all. In those circumstances, the insurer would refuse to pay out on your claim, or could impose Continue Reading

Road Accident Injury Claims: Details To Get From The Other Driver

You have been involved in a road traffic accident with another vehicle, which was not your fault. You have suffered injury as a result. You need to make a claim for your injuries and other losses. Motor insurance is compulsory and so the aim will be to make the claim against the insurers of the third party driver. What are the details you need to get from the other party involved in the accident? Aside from the situation where you are not able to get the information at the scene because you or the other driver is so seriously injured, it can be helpful if you can manage to get: (most important of all) the registration number of the other vehicle the make, model and colour of the other vehicle the name and address of the driver of the other vehicle the name and address of the insurers of the other vehicle the policy number or claims reference number for the other party and their insurers. If the police attend the scene of the Continue Reading

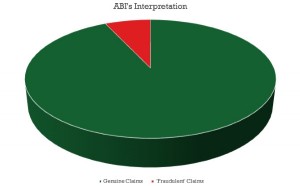

Whiplash Injury: UK Insurers Told By MPs To Sort Out Their Practices

MPs consider the effect of whiplash claims on motor insurance premiums The UK Parliament’s Cross-Party Transport Select Committee published its report “Cost of Motor Insurance: Whiplash” on 31 July 2013. The Westminster Government’s perception is that there is an increasing number of whiplash personal injury claims following road traffic accidents – some of which are invented by the supposed victims and, even where genuinely-based, the extent of the injury is often exaggerated. In the Government’s eyes, this is pushing up the cost of motor insurance. The Government has described the UK as “the whiplash capital of the world”. The Select Committee considered these issues as part of its remit. What is Whiplash and Why is it Problematic? The definition for whiplash used by the Committee was: “The neck pain which occurs after the soft tissue in the spine has been stretched and strained when the body is thrown in a sudden, forceful jerk.” This is a typical result of the Continue Reading

Car Insurance: When the “Best Deal” may be False Economy (If In Doubt – Disclose)

When you’re insuring your car, you’re looking for the best deal and that usually means the cheapest deal. In that environment, it is easy to think that a little 'white lie' about your vehicle or your circumstances will not hurt you if it saves you a few pounds. That is a risky and inadvisable approach, as a recent decision from Greenock Sheriff Court illustrates. The claimant in that case had insured his Audi with Zenith Insurance. When the vehicle was stolen, he claimed on his car insurance for the value of the vehicle. The claim was refused. Zenith said they were treating his policy as void. They refunded the premiums he had paid (amounting to about £1,440) but refused to pay him the value of his car (about £20,000). He sued Zenith for payment of the value of the car. He lost. Insurance contracts are contracts of the utmost good faith Basically, this means that you, as the insured, have a duty to disclose all material or “important” facts that might have Continue Reading