This is a case study of an injury claim arising from a pavement tripping accident. We’ll go through the stages of the claim from intimation of claim to the point where insurers admitted liability. It was not a straightforward process. In our experience, that is not unusual. We hope this will give you an illustration of what can happen with a personal injury claim for tripping injuries. The facts show why perseverance with a claim may be necessary. Here’s a photo of the pavement where the injured person fell. At the time of the accident, the injured person was walking into the photo (i.e. away from the cameraman). The injured person's left foot went down on the edge of hole at a point where it was about 3cm deep. This caused them to go over on their left ankle and suffer an inversion injury to it. Scottish local authorities generally have a duty to repair pavement defects once they produce a height difference of more than 2cm (20mm). This is a height difference Continue Reading

Why a cyclist’s fault for an accidental injury can have drastic financial consequences

Ned Ryerson must be one of the most beloved “annoying” characters in film history. He is the insurance salesman from Phil Connors’ past who keeps turning up to bug Phil. He appears at the same point on Phil’s walk from his Punxsutawney guesthouse to Gobbler's Knob, as Groundhog Day repeats over and over again. It’s one of my all-time favourite films – one which includes a happy ending for Ned, as he explains: “I have not seen this guy for 20 years but he comes up to me and then he buys whole life, term, uniflex, fire, theft, auto, dental, health – with the optional death and dismemberment plan – water damage… Phil, this is the best day of my life!” The “optional death and dismemberment plan” may be a joke (maybe it isn’t) but the list of so many different types of insurance illustrates that insurance is varied and can be complicated. And while it’s possible to be over-insured, so it’s possible to be under-insured – and under-insurance is one of the things we’ll look at Continue Reading

What are the main reasons why a driver will be to blame for an accident?

Brené Brown is an American research professor. She is based at the Graduate College of Social Work at the University of Houston. She is a best-selling author, covering topics such as shame, vulnerability, empathy and courage. Describing herself as a researcher and storyteller, in this revealing and entertaining animated video, she also describes herself as a “blamer”. She manages to make blaming her husband, Steve (for her dropping - and splashing over herself - a full cup of coffee), sound understandable and reasonable. All he did was come home half an hour late the evening before and shorten her night’s sleep by the same amount. But for his lateness, however, she wouldn’t have been so tired as to need the second cup of coffee she then spilt on herself. As Brene Brown asks: how many of us go to that place, when something bad happens? Where the first thing we want to know is: “whose fault is it?” And we’d rather it be our fault than no one's fault - because it gives Continue Reading

Slipping accident on retail premises: a case study

Ms S visited a fast food restaurant in Elgin at the end of a night out. She needed to use the customer toilets. She went through the door from the restaurant into the ceramic-tiled corridor which led to the toilets. Though she did not notice the fact until after she had fallen, the floor was wet. This caused her to slip. As a result of her fall, she suffered an injury to her back. A "wet floor" sign was put out in the corridor, immediately following her accident. She reported her accident to a member of staff at the time but it was not until the next day that she realised the severity of the injury. She had the presence of mind to write a letter to the manager of the fast food restaurant informing him of the fact and details of her accident. Grigor & Young made a compensation claim on Ms S’s behalf, in this case. At all times, liability was denied. The fast food restaurant did not accept that, in fact, the floor had been wet at the time. They did not accept Continue Reading

Why employers face greater risk from injury claims due to employee negligence

Who you claim compensation from via a personal injury claim is not always as obvious as it may appear. In a road traffic accident, it’s the negligent driver who injured you that’s first in line. But it’s usually their motor insurer who pays the compensation. And it’s that insurer you will sue if you have to raise a court action to ensure your claim succeeds and you secure a reasonable level of compensation. If the driver was at work at the time of the accident, you might also have a claim against the driver’s employers under the law of vicarious liability. What do we mean by vicarious liability? “Vicarious” experience is where you live your life through the experience of another person, as a housebound parent might experience the wider world through their student child reporting back on travels during a gap year. Or a precocious child, such as Calvin from Calvin and Hobbes, might claim that his Dad is trying to live Calvin's life vicariously because Calvin's Dad's life is Continue Reading

Knee injury compensation claims

Dr Carl Wunderlich, who died in 1877, is famous for his measurement of average healthy body temperature of 37°C. (98.6°F). Using a thermometer reputedly a foot in length - and needing 20 minutes to register the temperature – he tested around 25,000 patients and took over 1 million readings. He was at the forefront of medical science for his time but his “normal body temperature” of 37°C has gradually been seen as an oversimplification of reality. In fact, normal temperature is actually a range because no two human bodies are the same. In addition, we all react differently to external factors and disease. Body temperature can also vary according to: how much we’ve eaten; our stress levels; hormones; and different levels of exercise. Something – normal body temperature - that, at a glance, seems simple turns out to be much more complicated. And this is also the case with the human knee. On the face of it, the knee simply joins the top of the leg with the bottom of the leg. Continue Reading

Getting the sack for making a personal injury claim (health and safety protections)

The fear of being dismissed. It’s a fear that prevents many people claiming compensation for personal injury sustained at work. We’ve considered this general issue in other articles. In this article, we focus on protections which might apply via employment law, and health and safety law. It’s a discussion of health and safety at work, workplace danger and sections 44 and 100 of the Employment Rights Act 1996. Employers have extensive health and safety duties towards employees. And also to workers, self-employed people and visitors to their workplaces. The principal legislation in relation to health and safety is the Health and Safety at Work Act 1974. This sets out basic health and safety duties. They apply to companies, directors, managers and employees. As the director or owner of a company, you have potential personal liability as well: you can't hide behind your company. The nature and extent of the duties in practice will depend very much on the type of business concerned. The Continue Reading

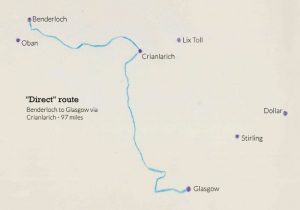

Why an accident in Scotland means you need advice from a Scottish solicitor

If you have an accident in Scotland, you need to get advice from a Scottish solicitor. People contact us with personal injury related questions via this website from all over the place (not always in the UK and not always even in Europe). Where the enquiry is about an accident that happened outwith Scotland, we cannot help you directly but we can often use our professional contacts to point you in the right direction. It’s even more focused than "Scotland" for us, however, because we concentrate our main efforts on helping clients in our home area of Moray and a bit beyond that. One phone enquiry we received recently caused us a lot of concern and that’s the seed for this article: The risk that you might have a question about injuries arising from an accident in Scotland but not get advice from a Scottish solicitor. Here’s (an anonymised version of) the scenario that came from the phone enquiry mentioned above. A parent of the caller had died as the result of a road Continue Reading

Why cyclists must get legal advice about a possible personal injury claim

The volume of water that breaks off Antartica as icebergs each year is greater than the total global consumption of freshwater. And icebergs are pure freshwater. Not for the first time, schemes have been proposed to tow icebergs to hot, water-stressed regions of the world. In Spring 2018, for example, before the rains finally came, the four million people in Cape Town, South Africa, came perilously close to ‘Day Zero’ – when they would run out of water. Though the idea of using icebergs in this way originated as long ago as the 19th Century, no plan has ever been put into action. The idea makes even more sense when you think of icebergs otherwise being “wasted” by melting into the salty seas. Of course, another feature of icebergs is that much more of them lie below the waterline than above. Ships need to be aware that initial appearances are deceptive where icebergs are concerned. In this article, we are going to consider why a superficial approach does not work and why Continue Reading

3 Important Features of Accidents involving Work at Height

Sunday, 26 August 2018 marked the 90th anniversary of the “snail in the ginger beer bottle” incident. While enjoying a drink with a friend in the Wellmeadow Café in Paisley, May Donoghue found an unwelcome addition to the contents of her bottled drink in the form of a decomposing snail. The injury she suffered when she drank the unpleasant mixture gave rise to the case of Donoghue –v- Stevenson, one of the most famous personal injury cases of all time. Though you would more readily link cheese with a mouse than ginger beer with a snail, it was ironic that a dead animal should again feature in a personal injury scenario reported so close to Donoghue –v- Stevenson’s 90th anniversary. On 22 August 2018, Kirkwall Sheriff Court dealt with a criminal prosecution arising out of an accident in a cheese factory in Orkney. A dead mouse caused an employee to have to work at a height from which he (the employee) fell and suffered injury. In this article, we will look at three aspects of work Continue Reading

Why a personal injury element is essential to a no win-no fee claim

Or, to put it another way, why don’t pure property damage claims work no win no fee? Dealing with motor insurers can be a frustrating process. This article was prompted by a question via the Grigor & Young website. The person making the enquiry said of their dealings with the third party insurers: It is an ‘online’ process and one is left for long periods of time on the telephone (twice my phone has run out of power from being fully charged) while trying to get a response. The enquirer had been involved in a road traffic accident that was not their fault. Their car was damaged and needed repairs. The car belonged to one of their parents. They were insured to drive the parent’s car through their comprehensive insurance on their own car. Ordinarily, in a “comprehensive” scenario, you may well choose to claim under your own policy (even if the accident was not your fault) because you have a contract with your insurers. You have more control. You have more clout if Continue Reading

4 ways to avoid problems with your whiplash injury claim (that your solicitor can’t really tell you about)

Whiplash injuries are problematic because they are soft tissue injuries. They cannot be identified or confirmed on any form of medical scan. They can be difficult to diagnose. Because of this, they are controversial injuries. They can be exaggerated. It is said that they can even be faked. In May 2018, the insurer Aviva reported that the value and volume of fraudulent claims detected by them had increased for the second consecutive year. Aviva said it now rejected around one in eight whiplash claims because they were suspect or considered to be fraudulent. Putting the case for personal injury victims, on the other hand, the Association of Personal Injury Lawyers (APIL) pointed out that on the Association of British Insurers' own figures, only 0.17% of all motor claims are proven to be fraudulent. Motor claims include property claims due to fire, theft and damage, as well as personal injury. In other words, not all motor claims involve a personal injury element, so only a Continue Reading