If you travel with a drunk driver and get injured due to their bad driving, does that mean you can’t claim? A September 2019 poll commissioned by Glasgow-based solicitors, Dallas MacMillan, indicated that two-thirds of those polled believed that if you agree to be a passenger in a car driven by someone you know is under the influence of alcohol, you won’t be able to claim compensation from the driver if they crash the car and you’re injured. This 66% (or so) majority are mistaken in their understanding of the law. People injured in such circumstances can claim successfully – and you may be surprised by how fully they can claim. We agree that travelling with a driver who is under the influence is a very bad idea. On the other hand, you should not lose sight of the fact that passengers in vehicles very rarely have no compensation claim available to them if they are injured in an accident. In this article, we’ll look at the law on accidents involving passengers in vehicles driven Continue Reading

Avoiding Child Pedestrian Accidents

School crossing patrols stopped in Moray from 20 August 2019. Meaning no more lollipop people to guide our children across the roads. We have to hope that the publicity this controversial Council cutback has received will mean all drivers will take extra special care when in the vicinity of any Moray school. In this article, we will consider 3 matters in relation to pedestrian road traffic accidents involving children. Firstly, we will consider the evidence about road safety measures such as school crossing patrols and why they provide useful benefits. We will then go on to look at the relative duties of drivers and child pedestrians and what scope there is for some of the blame falling on the injured child (contributory negligence). Finally, by means of an example, we will examine the issues that can arise along with contributory negligence, including possible shifting of blame onto a parent who has not taken proper care for their child's safety (in letting them out alone Continue Reading

How safe are you on Moray’s roads?

1,793 people were killed on Britain’s roads in 2017. That figure comes from statistics published by the Road Safety Foundation ('RSF') in July 2019. It means that average of 73 people were killed or seriously injured on Britain’s roads every day. In spite of ongoing improvements in vehicle safety, the annual number of fatalities has changed little since 2011. Across Europe as a whole, the ambitious long-term goal is that, by 2050, we should be getting close to zero road deaths – which would mean road travel achieving similar safety levels to rail and air travel. The good news in Scotland is that we have made measurable progress in improving road safety over the last 3 years. During that time, the risk of death and serious injury has fallen by about 7% across motorways and ‘A’ roads in Scotland. Scotland now has the lowest rate for deaths/serious injury per head of population for travel on major routes – at 13 per billion vehicle kilometres. (In England, it’s 15 and, in Continue Reading

Why a cyclist’s fault for an accidental injury can have drastic financial consequences

Ned Ryerson must be one of the most beloved “annoying” characters in film history. He is the insurance salesman from Phil Connors’ past who keeps turning up to bug Phil. He appears at the same point on Phil’s walk from his Punxsutawney guesthouse to Gobbler's Knob, as Groundhog Day repeats over and over again. It’s one of my all-time favourite films – one which includes a happy ending for Ned, as he explains: “I have not seen this guy for 20 years but he comes up to me and then he buys whole life, term, uniflex, fire, theft, auto, dental, health – with the optional death and dismemberment plan – water damage… Phil, this is the best day of my life!” The “optional death and dismemberment plan” may be a joke (maybe it isn’t) but the list of so many different types of insurance illustrates that insurance is varied and can be complicated. And while it’s possible to be over-insured, so it’s possible to be under-insured – and under-insurance is one of the things we’ll look at Continue Reading

What are the main reasons why a driver will be to blame for an accident?

Brené Brown is an American research professor. She is based at the Graduate College of Social Work at the University of Houston. She is a best-selling author, covering topics such as shame, vulnerability, empathy and courage. Describing herself as a researcher and storyteller, in this revealing and entertaining animated video, she also describes herself as a “blamer”. She manages to make blaming her husband, Steve (for her dropping - and splashing over herself - a full cup of coffee), sound understandable and reasonable. All he did was come home half an hour late the evening before and shorten her night’s sleep by the same amount. But for his lateness, however, she wouldn’t have been so tired as to need the second cup of coffee she then spilt on herself. As Brene Brown asks: how many of us go to that place, when something bad happens? Where the first thing we want to know is: “whose fault is it?” And we’d rather it be our fault than no one's fault - because it gives Continue Reading

Why cyclists must get legal advice about a possible personal injury claim

The volume of water that breaks off Antartica as icebergs each year is greater than the total global consumption of freshwater. And icebergs are pure freshwater. Not for the first time, schemes have been proposed to tow icebergs to hot, water-stressed regions of the world. In Spring 2018, for example, before the rains finally came, the four million people in Cape Town, South Africa, came perilously close to ‘Day Zero’ – when they would run out of water. Though the idea of using icebergs in this way originated as long ago as the 19th Century, no plan has ever been put into action. The idea makes even more sense when you think of icebergs otherwise being “wasted” by melting into the salty seas. Of course, another feature of icebergs is that much more of them lie below the waterline than above. Ships need to be aware that initial appearances are deceptive where icebergs are concerned. In this article, we are going to consider why a superficial approach does not work and why Continue Reading

Why a personal injury element is essential to a no win-no fee claim

Or, to put it another way, why don’t pure property damage claims work no win no fee? Dealing with motor insurers can be a frustrating process. This article was prompted by a question via the Grigor & Young website. The person making the enquiry said of their dealings with the third party insurers: It is an ‘online’ process and one is left for long periods of time on the telephone (twice my phone has run out of power from being fully charged) while trying to get a response. The enquirer had been involved in a road traffic accident that was not their fault. Their car was damaged and needed repairs. The car belonged to one of their parents. They were insured to drive the parent’s car through their comprehensive insurance on their own car. Ordinarily, in a “comprehensive” scenario, you may well choose to claim under your own policy (even if the accident was not your fault) because you have a contract with your insurers. You have more control. You have more clout if Continue Reading

4 ways to avoid problems with your whiplash injury claim (that your solicitor can’t really tell you about)

Whiplash injuries are problematic because they are soft tissue injuries. They cannot be identified or confirmed on any form of medical scan. They can be difficult to diagnose. Because of this, they are controversial injuries. They can be exaggerated. It is said that they can even be faked. In May 2018, the insurer Aviva reported that the value and volume of fraudulent claims detected by them had increased for the second consecutive year. Aviva said it now rejected around one in eight whiplash claims because they were suspect or considered to be fraudulent. Putting the case for personal injury victims, on the other hand, the Association of Personal Injury Lawyers (APIL) pointed out that on the Association of British Insurers' own figures, only 0.17% of all motor claims are proven to be fraudulent. Motor claims include property claims due to fire, theft and damage, as well as personal injury. In other words, not all motor claims involve a personal injury element, so only a Continue Reading

Uninsured and untraced drivers and personal injury claims

It's compulsory to have insurance to cover the risk that a third party will suffer loss because of your driving That’s the case whether the “injury” is to property or a person. As at 2016, however, figures published by Churchill Insurance suggested that, across the UK, there were estimated to be over a million uninsured motorists. In the worst urban hotspots (e.g. parts of London), you have as much as a one in eight chance that any motorist involved in an accident with you will be uninsured. What are important things to know if you are involved in an accident with an uninsured (or untraced) driver? The Government set up the Motor Insurers’ Bureau (MIB) in 1946. It is a limited company and it aims to help those who have suffered loss due to the actions of an uninsured or untraceable driver. The underlying principle is that no person should be left uncompensated because a driver who causes an accident is uninsured. Since the 1970s, the MIB has been an important means by Continue Reading

When can you claim for the loss in value of a repaired car?

Where there is a personal injury claim arising out of a road traffic accident, there is often a claim for damage to a car as well. As we have discussed elsewhere, claims for damage to vehicles will be valued on the basis of the lower of: the cost of repairs; and the net pre-accident value of the vehicle (in other words, the pre-accident value of the vehicle, less any scrap value). Another way of putting it is to say that, if the cost of repairing your vehicle will be “too high” relative to its value, the maximum you will get for it will be its net pre-accident value. What if your car was very new when it was damaged? In that case, while it may be economical to repair the vehicle, you might well feel that your repaired vehicle - even if it has been very well repaired – has lost value compared to what it would have been worth for resale if it had not been in an accident at all. It’s an interesting question: whether the owner of a car which is damaged in a road traffic Continue Reading

What are your rights following a road traffic accident that was not your fault?

The Competition & Markets Authority (CMA) is a UK government department, responsible for strengthening business competition and preventing and reducing anti-competitive activities. In September 2014, it produced a report following an investigation into the private motor insurance market. One of the things they considered was the possibility of providing improved information to consumers on their rights following an accident. They noted that there appeared to be market-wide support for such a measure. CMA found a poor level of awareness among consumers about their basic rights following a road traffic accident that was not the consumer's fault. The report summarises the legal and factual background to its remit. It explains how the law requires motorists to hold a valid insurance policy to cover “third party” risks. In other words, insure against the risk they will injure another person or their property through their driving and have to pay compensation for those Continue Reading

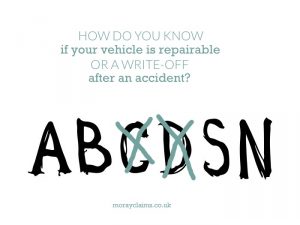

How do you know if your vehicle is repairable or a write-off after an accident?

If your vehicle is damaged in an accident, how your loss is measured will depend on whether it is regarded as economically repairable or not. In this process, it is the market value of the vehicle at the time of the accident which matters as the economic benchmark. The amount it’s insured for does not matter. Neither does the likely replacement cost. The seriousness of accident damage is ranked by insurance assessors using various categories. Prior to 01 October 2017, the four categories were A to D, with A being most seriously damaged and D least severe. In the name of “progress”, this logical system has now been replaced by something less intuitive. The categories are now A, B, S and N. Categories A and B are unchanged from before. Category A vehicles are so badly damaged that they must be scrapped and crushed. No salvage of parts for re-use is allowed. Under Category B, vehicles are again extensively damaged, though some parts may be salvageable. The vehicle must be Continue Reading